The term “supply chain” was coined on June 4, 1982, when the Financial Times published an article that used it as a replacement for “production and inventory management.” Now a permanent part of our lexicon, looking back at just how the supply chain has grown and changed over four decades is how a panel of industrial leaders began their presentation at NAIOP’s I.CON West, held this week in Long Beach, California.

“Take a walk back to the 1980s,” invited Rich Thompson, international director, supply chain & logistics solutions, Americas, JLL. “There were no laptops, no internet, no cell phones and no Amazon. Catalog orders took around 14 days to arrive, and retail real estate was hot.”

Today, supply chain is an increasingly popular field of study, Amazon is the second largest employer in U.S. and the third most valuable in terms of revenue, and online orders are delivered in two days – or less – at no change. Industrial is hot.

Retailers are investing huge amounts of capital to meet e-commerce demand, said Thompson. Walmart is investing $14 billion in automation, and the online grocery segment is ramping up to be able to offer delivery within hours. This is all good news for industrial real estate but means retailers must continue to locate closer to the customer to shorten time and transportation costs. Amazon spends $68 billion on transportation each year.

Gregg Healy, executive vice president with Savills, said the interconnectivity of everything e-commerce is driving growth, never more obvious than during the last 18 months as the COVID-19 pandemic accelerated e-commerce demand. Healy said that 26% of U.S. retail sales will be online by 2025, surpassing the worldwide average of 24%.

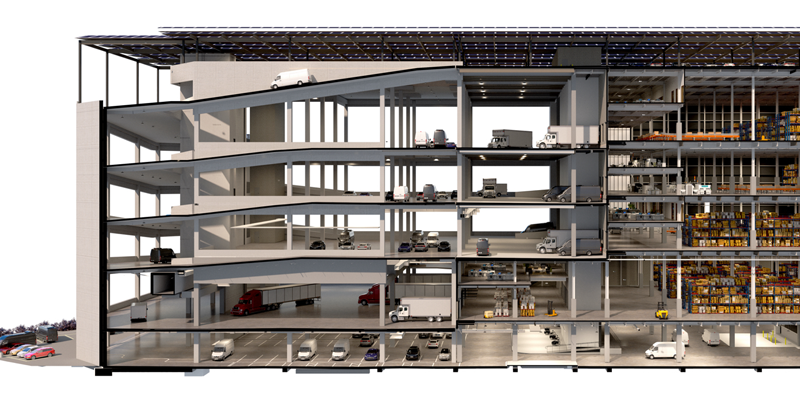

To meet that demand, an additional 1.5 billion square feet of industrial space will be needed worldwide, including 400 million square feet of new industrial supply in the U.S. With 700 million square feet expected to deliver in the next two years, will there be a glut of industrial space if the speed of e-commerce sales slows?

No, said Healy, noting that there are plenty of other needs for industrial space, including advanced manufacturing, 3D printing, reshoring activities, and supply chain resilience countermeasures in the event of global instabilities.

Healy has a history of work in Asian markets and noted that 57% of retail sales in China will be online by 2025, and a lot of those purchases will be on mobile phones. “America has a long way to go in terms of e-commerce fulfillment space and infrastructure development,” he said.

Barbara Perrier, vice chairman, CBRE, said that when she began her career, many encouraged her to go into retail, but she opted for an industrial focus. “Thirty-three years later, this was a great decision,” she laughed.

Every $1 billion of additional e-commerce sales requires an additional 1 million square feet of industrial space, so projecting space requirements as e-commerce sales surge can be difficult. Perrier said that more than 60% of demand for industrial space is coming from third-party logistics companies (3PLs) – companies like FedEx, UPS, DHL and others that are servicing e-commerce fulfillment. Other drivers of demand are general retail/wholesale; food and beverage (cold storage); manufacturing; automobiles, tires and parts; building materials/construction and medical.

“The capital markets are changing, and new product types are very popular,” said Perrier. “I’ve never seen cap rates so low, and it’s here to stay.”

“We are running out of superlatives to describe industrial’s growth, but let’s talk about challenges,” said Chris Burns, regional executive vice president, Duke Realty.

The first is people – attracting the right talent, which was a growing issue even before the pandemic. “We have to pay attention to who we hire, but also focus on retaining our talent. This isn’t an issue exclusive to developers. Our tenants are offering bonuses for people to work in warehouses. This is a challenge from retail to restaurants to Amazon.”

Burns said that there are increased risk factors that must be considered through the lenses of land and entitlement. “Municipalities are taking a much different stance than they were coming out of the Great Recession. Now it’s beyond the economy; it’s about trucks on the road, air quality, ESG (Environmental, Social and Governance),” he said. “We are seeing elongated timelines, legal challenges from environmental groups, and development moratoriums.”

He said Duke is carrying a significantly higher portion of pre-development costs for studies, surveys, architectural designs, plans and fees for applications, legal considerations, financing and consulting. “It’s not uncommon to spend up to $200,000 to see if a site is even going to work for the project,” he said.

Among the biggest concerns is the delay in lead time for materials, and significant price increases for steel, single-ply roofing, metal decking, precast concrete, switchgear (electronic components) and dock equipment.

On the positive side for landlords, rent growth is rising almost everywhere. “We are seeing growth everywhere from Cincinnati to Chicago. Southern California and New Jersey are on fire,” said Burns.

Panel moderator David Hudson, president – Griffin Partners Development, Griffin Partners, Inc., asked the group how changes in municipality moratoriums in Southern California might change where companies are located. Perrier said that some companies may go to other markets, like Arizona or Texas or Nevada, but Healey warned that companies can’t afford to fully move away from a market of 30 million consumers. “50% of costs are transportation costs, so you have to stay close,” he said.

The “China Plus One” supply chain is a business strategy to broaden investment beyond just China and diversifying business locations to include other countries. “We have a much more regionalized world, and a resurgence of manufacturing in the U.S.,” said Thomspon. Healey said that while we can’t ignore that China has the largest consumer market in the world – there are more middle-class in China than the entire U.S. population – looking more broadly at sourcing or manufacturing in Indonesia and Thailand is critical when challenges like the COVID-19 pandemic emerge.

In closing, Hudson asked the panel to share one industrial-related concern that we aren’t paying enough attention to right now. Burns named talent but noted that cost increases and delays can significantly affect the development pipeline and the growth of companies.

Perrier said municipality cooperation, changing moratoriums and antidevelopment movements led by special interest groups are making it tougher to do business.

Healey said understanding how to be reliant, having a plan for automation, and curating a critical labor force. “We can create supply chain strategies all day and night, but we need the labor to make it work.”

Thompson said projecting demand is a key concern, noting that there is a lot of runway for growth in the U.S. “This is great news for industrial! Does anybody know anyone planning to do less e-commerce? There are huge opportunities in the business-to-business supply chain, which is three times larger in sales than business to consumer. There’s going to be a domino effect as these B2B partners strive to catch up on speed of delivery expected by consumers.”

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s I.CON West 2021. Learn more about JLL at www.us.jll.com or www.jll.ca.