As 2023 comes to a close and we look ahead to the challenges facing commercial real estate in 2024, it is clear that persistent advocacy on the public policy front will be more important than ever to ensure that the interests of NAIOP members are protected. This is true of course at the state and local level, but it is at the federal level, where government gridlock has been most on display, that maintaining our strong advocacy will be critical.

As some media reports have already noted, this Congress will be one of the most unproductive since the Great Depression. Just 20 pieces of legislation have been signed into law. Narrow partisan majorities in the House and Senate, and continued dysfunction in the House Republican conference in particular, have made advancing legislation in this Congress an even bigger challenge than usual. For three weeks, Congress lost valuable time while the drama surrounding Speaker Kevin McCarthy unfolded, with Republicans finally settling on the fourth candidate to vie for the spot. While the House did manage to pass debt-ceiling increases and government funding measures that were “must-pass” bills, the only other bills that Congress seemed able to digest were those renaming post offices and those with no opposition at all.

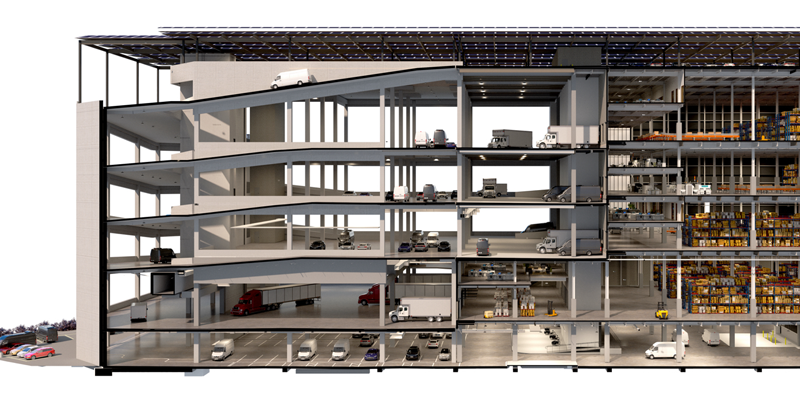

It was in this environment that NAIOP continued its strong advocacy on behalf of commercial real estate, advancing our public policy agenda. In 2023, NAIOP’s federal public policy priorities included focusing congressional attention on the continued stress in the office sector, where the permanence of remote-work patterns resulted in high vacancy rates and depressed asset values. We made incentivizing the adaptive reuse of commercial structures a top legislative priority, arguing that federal incentives to spur conversions of these buildings to residential use would also help alleviate some of the affordable housing needs of communities.

While some property conversion legislation had been introduced, it was overly restrictive and impractical from a development standpoint. It was NAIOP members from our Central Ohio chapter, at a meeting with the tax staff of Representative Mike Carey (R-OH) during NAIOP’s Chapter Leadership and Legislative Retreat early in the year, which made him take up the issue. Since then, Carey has been reaching out to House and Senate Democrats to build bipartisan support for legislation that would have a meaningful impact on the problem, with an eye to introducing legislation that could be added to a larger tax package that could move early next year.

Advocating for broader tax policy that recognizes the unique nature of commercial real estate was also a top priority this year. As we anticipated, the Biden administration early in the year delivered its fiscal year 2024 budget proposals to Congress, which included tax provisions harmful to commercial real estate and which necessitated our continued education efforts on the Hill to ensure that none of these would be included in any year-end tax agreement. Among the proposals were capital gains tax increases, elimination of Section 1031 tax-deferred exchanges for commercial real estate, increases on the taxation of partnerships and other pass-through entities, and taxing carried interests at much higher ordinary income tax rates. The groundwork we did on tax policy this year was critical as we move into a presidential election year, where taxes are guaranteed to be a flashpoint between the parties.

In 2023, NAIOP’s regulatory policy priorities also saw positive developments. As we had predicted on wetlands regulations, the U.S. Supreme Court ruled on a case that clarified the federal government’s jurisdiction over “waters of the United States” (“WOTUS”) as defined in the Clean Water Act, an issue that NAIOP had highlighted in its advocacy. As a result, the Biden administration was forced to revise its more expansive WOTUS regulation. Regarding the climate disclosure regulation proposed by the Securities and Exchange Commission (SEC), which would have been problematic for commercial real estate in some areas, the SEC had to delay the proposed regulation after another Supreme Court ruling on the extent of federal agency discretion in the rulemaking process. The SEC will need to take into further account the public’s input, including commercial real estate, to ensure the rule withstands legal challenges.

These were all positive developments for 2023, but the work remains for 2024. News stories on the continuing struggles of the office market abound, so adaptive reuse legislation will continue to be a priority as will the related issue of housing supply and affordability. In 2024, the lack of credit availability will be a major focus of our policy agenda, as financial regulators pressure banks to reduce their exposure to commercial real estate. A wave of commercial real estate debt will need to be refinanced in the next few years, and policymakers will need to be educated on a looming credit crunch in the industry. Important tax provisions will expire over the next two years, and these will be in focus leading into the 2024 presidential election.

Many fall into the trap of thinking that nothing much will happen in a presidential election year, and in cases of major legislation that is often true. But the work that is done before the election will impact what happens in a lame-duck Congress directly after the election. Forty members of Congress have already announced their retirement from the House, but they will still be voting on measures until a new Congress is seated in January 2025. The policy debate that happens during the runup to the election, and how we influence that debate, also sets the stage for action thereafter. For these reasons, despite the current state of Congress, steadfast and continued advocacy on behalf of the commercial real estate industry is essential.