In 2023, the trend of transforming buildings into apartments saw a significant revival, nearing the peak levels of 2019 and 2020, as developers responded swiftly to the increased demand for housing after a two-year slowdown.

This resurgence resulted in the creation of 12,713 new apartments, marking a substantial 17.6% increase from the previous year. The momentum for adaptive reuse is expected to continue, with an estimated 151,000 rental apartments currently being converted, including 58,000 from former office spaces.

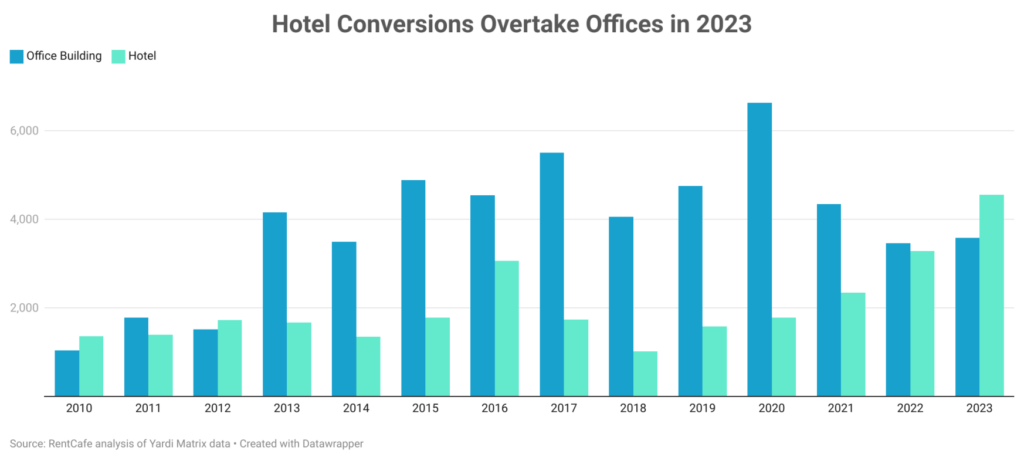

Notably, while office spaces are popular for future projects, hotel conversions dominated last year’s adaptive reuse landscape: A record 4,556 apartments emerged from repurposed hotels in 2023 alone, a 38.8% increase from the previous year and nearly double the output in 2021. This surge in hotel conversions is the most significant since 2016, which saw 3,061 apartments created.

Hotel conversions, which made up more than one-third of adaptive reuse projects nationwide in 2023, benefit from the infrastructure already present in these buildings, such as plumbing and electrical systems. This has made them a faster, cost-effective option for creating housing in dense urban areas where new construction is limited or expensive.

Office buildings also played a significant role, with 3,587 apartments developed from such spaces in 2023, up 3.8% over the previous year, although significantly below previous highs. Meanwhile, conversions from outdated factories produced 1,954 apartments, accounting for 15% of the total rental units created through adaptive reuse nationwide — up 31.6% year-over-year. Warehouses saw a remarkable 128.8% surge from one year prior, with 1,098 units repurposed, representing 9% of all adaptive reuse projects completed in 2023.

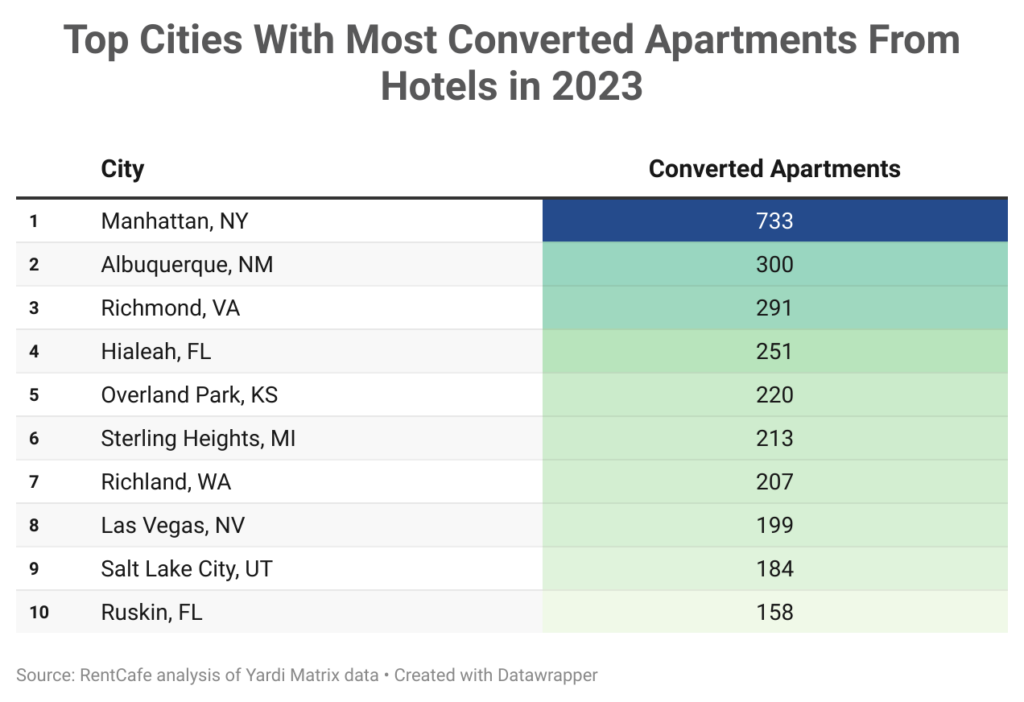

Manhattan leads in hotel-to-apartment conversions; Atlanta suburb excels in repurposing offices

Manhattan topped the list for apartment conversions, with 733 new units (all created from repurposed hotels), now accounting for 5.8% of all converted apartments in 2023. The bulk of Manhattan’s conversions stemmed from a former hotel at 525 Lexington Ave. in Turtle Bay, which was transformed into 655 student apartments. Following closely was Richmond, Virginia, with 662 apartments, and Alameda, California, with 372 units converted mainly from warehouses.

Interestingly, Albuquerque, New Mexico, emerged as a new leader in hotel conversions, creating 300 new apartments from former hotels, ranking second only to Manhattan.

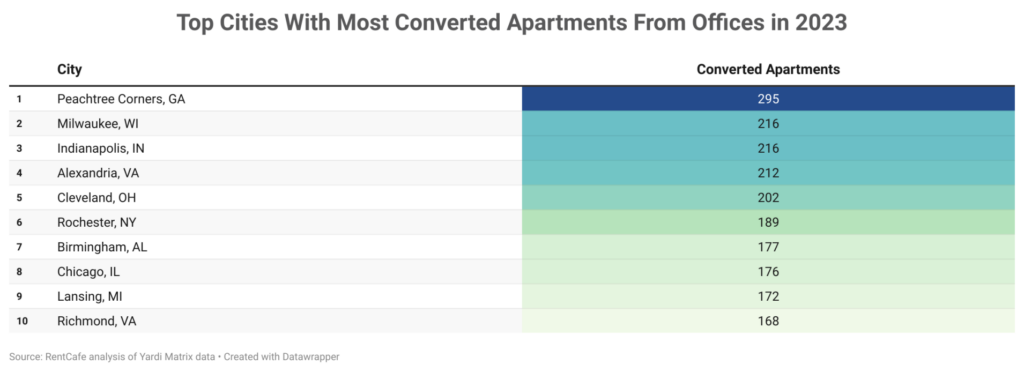

Similarly, Peachtree Corners, a suburb of Atlanta, led the way in office-to-apartment conversions, transforming a 50-year-old building at 5672 Peachtree Parkway into 295 modern apartments. This initiative is part of the city’s broader effort to modernize and enhance its appeal to both residents and businesses.

Milwaukee and Indianapolis closely followed, each converting former office spaces into 216 apartments, tying for second place. Milwaukee’s noteworthy projects included the transformation of the historic Milwaukee Sentinel building into 141 apartments and the 120-year-old Underwriters Exchange Building into 75 affordable units. Indianapolis saw a significant conversion at 220 Meridian.

Other cities also made the top 10 list for 2023, each featuring a single office conversion project. These included Alexandria, Virginia, with 212 units; Cleveland with 202 units; Rochester, New York, with 189 units; Birmingham, Alabama, with 177 units; Chicago with 176 units; Lansing, Michigan, with 172 units; and Richmond, Virginia, rounding out the list with 168 units.

What’s ahead for adaptive reuse apartments?

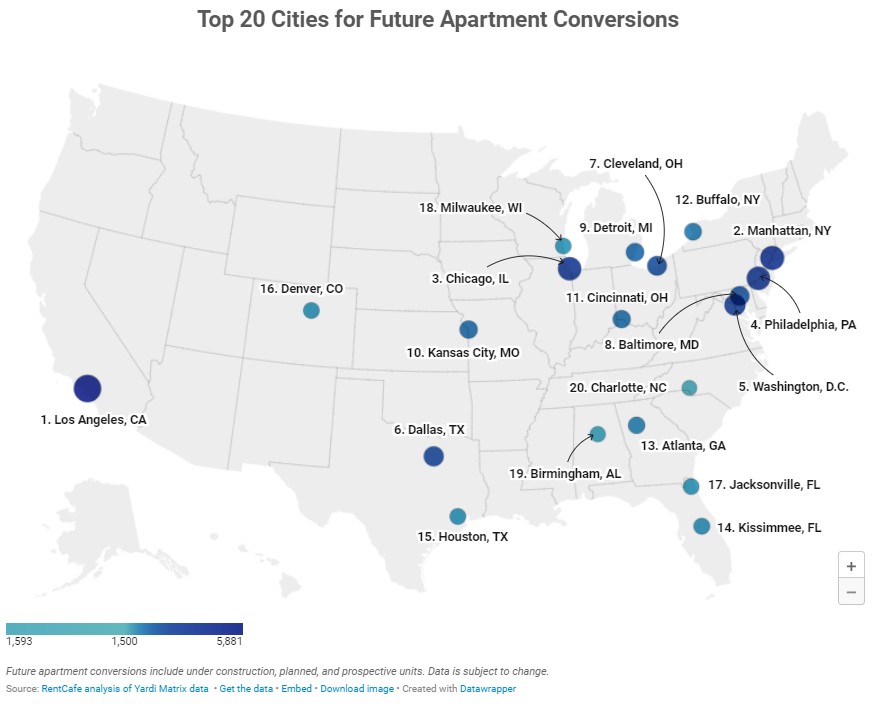

Looking ahead, adaptive reuse is set to expand even more, with over 151,000 apartments in various stages of conversion across the U.S., marking a 24% increase from 2022’s 122,000 projected units. Offices are at the forefront of this movement, expected to contribute over 58,000 future apartments, making up 38.5% of all upcoming conversions.

Washington, D.C., is anticipated to lead in office conversions with about 3,000 units in the pipeline. Los Angeles is gearing up for a resurgence with 5,800 upcoming units, although only 1,700 of these will be brought to life from office buildings. Meanwhile, Manhattan, currently leading in conversions, is expected to produce almost 4,400 new apartments, with a significant portion originating from office spaces.

Hotels and factories are also significant contributors to future conversions, with about 34,000 and 18,000 apartments in the works, respectively.

For more highlights, as well as the full methodology, read the full report on RentCafe.com.