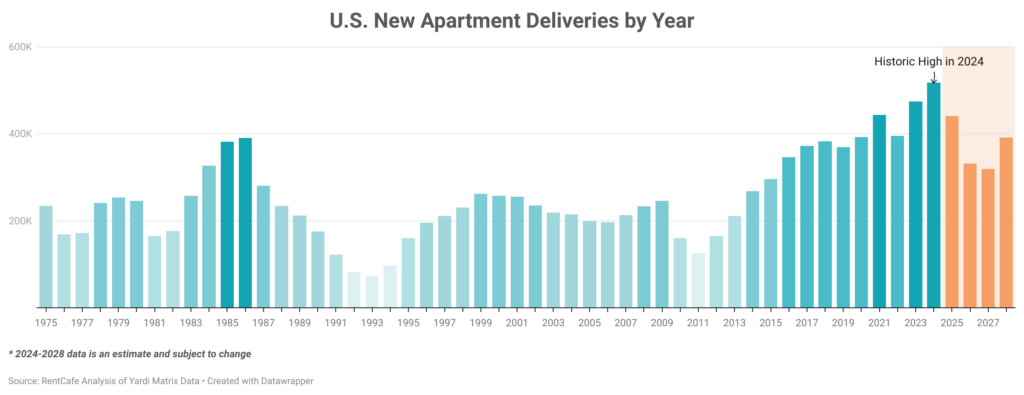

In 2024, the U.S. is set to achieve a new milestone in apartment construction: For the first time in history, the number of apartments completed in one year is anticipated to surpass the 500,000-unit mark. Developers are on track to complete over 518,000 rental units, which marks a significant 9% increase compared to 2023 and a 30% rise from 2022.

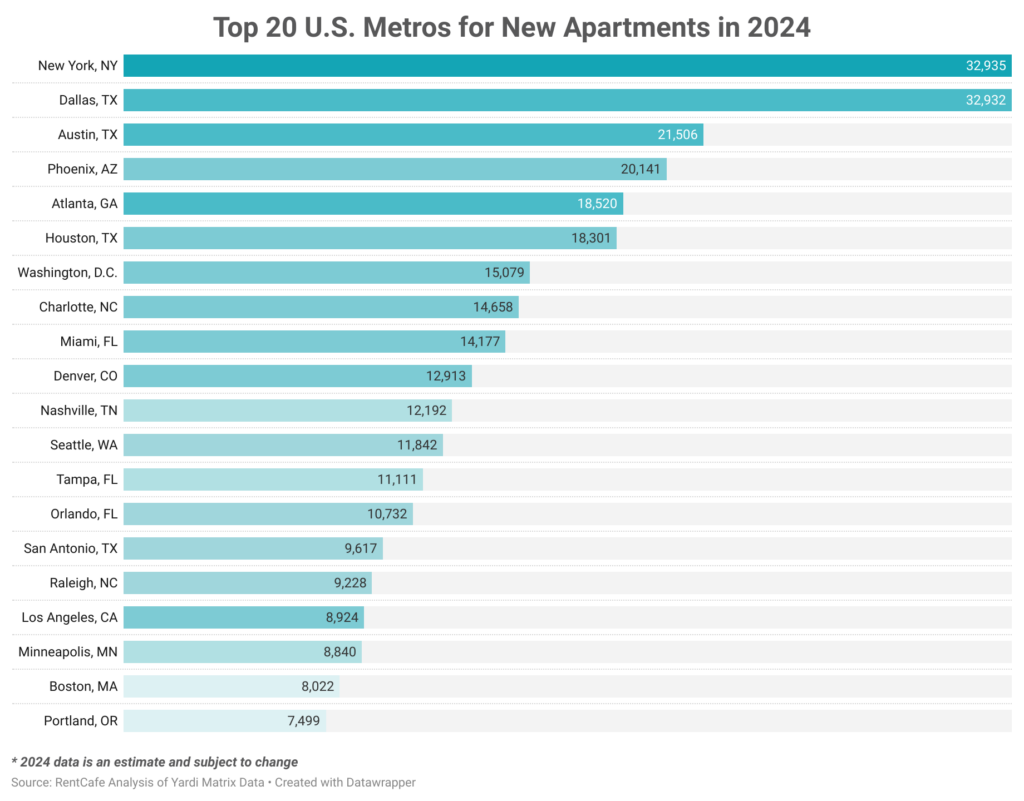

The New York metro area leads the nation in new apartment construction in 2024, followed by Dallas and Austin. Together, these three metros are expected to account for about 10% of all new apartments nationwide by the end of the year.

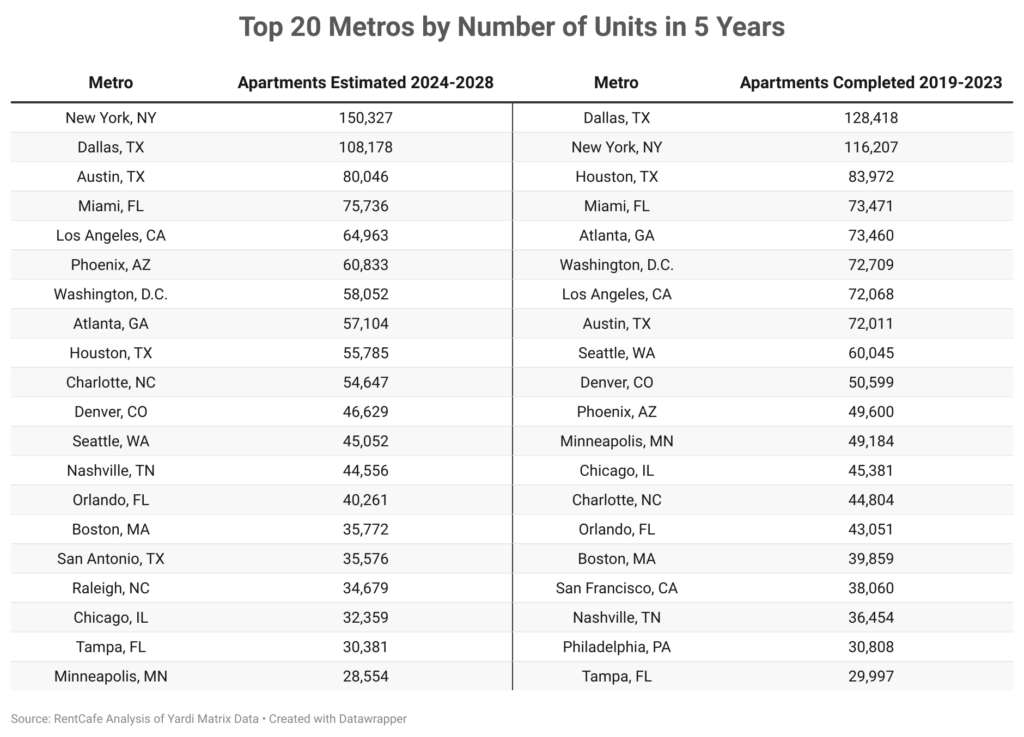

Looking ahead, developers plan to bring 2 million new apartments online by 2028, despite facing uncertainties in many markets. Approximately 47% of the 369 metro areas analyzed are projected to build more apartments in the next five years than they did between 2019 and 2023.

The demand for apartments continues to outpace supply, echoing the building boom of the early 1970s when baby boomers were entering the rental market. However, the new construction is unevenly distributed across regions, with nearly 60% of new apartments concentrated in the top 20 metro areas, leaving many smaller markets with limited growth.

A significant portion of the apartments built in the last five years, as well as those currently under construction, are high-end units catering to upper middle- and high-income renters. This focus on luxury apartments, combined with the concentration of new units in large metros, limits affordable options for renters in smaller markets.

Developers push forward in 2024 despite high borrowing costs, uncertainties

Despite the record-setting construction pace in 2024, developers are facing challenges such as high borrowing costs, which are prompting them to adjust their strategies for the coming years. Many are expected to focus on lower-risk projects or shift to markets with strong demand and job growth.

Although 2024 will see over 518,000 apartments completed, the pace of construction is anticipated to slow down in the coming years. In 2025, developers are expected to deliver around 440,000 new units, a 15% decline from 2024 levels.

This downward trend is projected to continue through 2027, with only 319,000 new apartments expected to be completed, marking a 10-year low. However, a significant rebound is expected in 2028, with about 391,000 new apartments anticipated, a nearly 23% increase from the previous year.

New York, Dallas are top metros for new apartment construction in 2024

The New York metro area is set to lead the nation in apartment construction for the third consecutive year, with nearly 33,000 new units expected to be completed in 2024. Brooklyn will see the largest share of these new apartments, with 9,379 units, followed by Manhattan with 2,979 units, and Jersey City, New Jersey, with 2,412 units. This surge in construction is driven by the persistent housing shortage in the Northeast.

The Dallas metro area is very close behind New York, with 32,932 new apartments expected by the end of 2024. Dallas proper will account for the bulk of these new units, followed by Fort Worth and Frisco.

In third place is the Austin metro area, with 21,506 new apartments expected in 2024, more than half of which will be in the city of Austin. Phoenix is expected to add 20,141 new apartments in 2024, with most of the construction concentrated in Phoenix proper. Rounding out the top five is Atlanta, with 18,520 new apartments expected by year-end.

New York to top apartment construction through 2028

Looking beyond 2024, developers are expected to complete about 2 million new apartments by 2028, roughly matching the number of rentals completed nationwide in the five years leading up to 2024.

However, the growth in new apartment completions is projected to slow down through 2027, followed by a significant jump in 2028. This slowdown is primarily due to a sharp decline in apartment construction starts in 2024, driven by stricter loan standards and economic uncertainties.

Despite these challenges, the New York metro area is projected to remain the top builder through 2028, with over 150,000 new apartments expected, a significant increase from the 116,000 units completed between 2019 and 2023.

Meanwhile, Dallas is expected to fall to second place, with just over 108,000 new units by 2028, down 28% from New York’s total. Austin is projected to complete around 80,000 new apartments by 2028, driven by its booming employment market, particularly in tech. Miami is expected to add nearly 76,000 new apartments by 2028, though this will likely fall short of meeting the high demand for housing in the metro.

Other top metros for new apartment construction through 2028 include Los Angeles, Phoenix, Washington, D.C., Atlanta, Houston and Charlotte, North Carolina. Notably, San Antonio and Raleigh are expected to see significant increases in new apartment completions compared to the previous five years.

Phoenix and Raleigh join New York in apartment growth surge

While many large metros are expected to slow down new apartment construction by 2028, several smaller markets are poised for significant growth.

For example, Youngstown, Ohio, is projected to see a substantial increase in new apartments, driven by job growth in healthcare and tech sectors, as well as the expansion of Youngstown State University. Similarly, Sherman-Denison, Texas, located just north of Dallas-Fort Worth, is expected to see a surge in new apartments due to economic growth in semiconductor manufacturing and technology.

Conversely, some large metros are expected to slow the pace of new apartment construction. Houston, Minneapolis-St. Paul, Dallas, Atlanta and Seattle are all projected to see fewer new apartments by 2028 compared to the previous five years. Despite these slowdowns, these metros remain some of the nation’s heaviest builders, continuing to add significant numbers of new apartments to their housing stock.

For more highlights, as well as the full methodology, read the full report on RentCafe.com.