For the last few years, industrial real estate development has been on a tear, thanks to elevated demand for warehouse space. Specifically, increased demand for e-commerce – in conjunction with logistical difficulties – led companies to break ground on massive logistics and distribution centers. Now, with warehouse space vacancies normalizing and speculative projects slowing down, CommercialCafe highlighted the next trend taking hold in industrial space construction: manufacturing facilities, particularly for electric vehicles (EVs) and semiconductors.

In a study analyzing the current state of industrial real estate construction and the current pipeline, CommercialCafe highlighted which markets have the most industrial space underway, as well as the largest projects slated for completion in 2024.

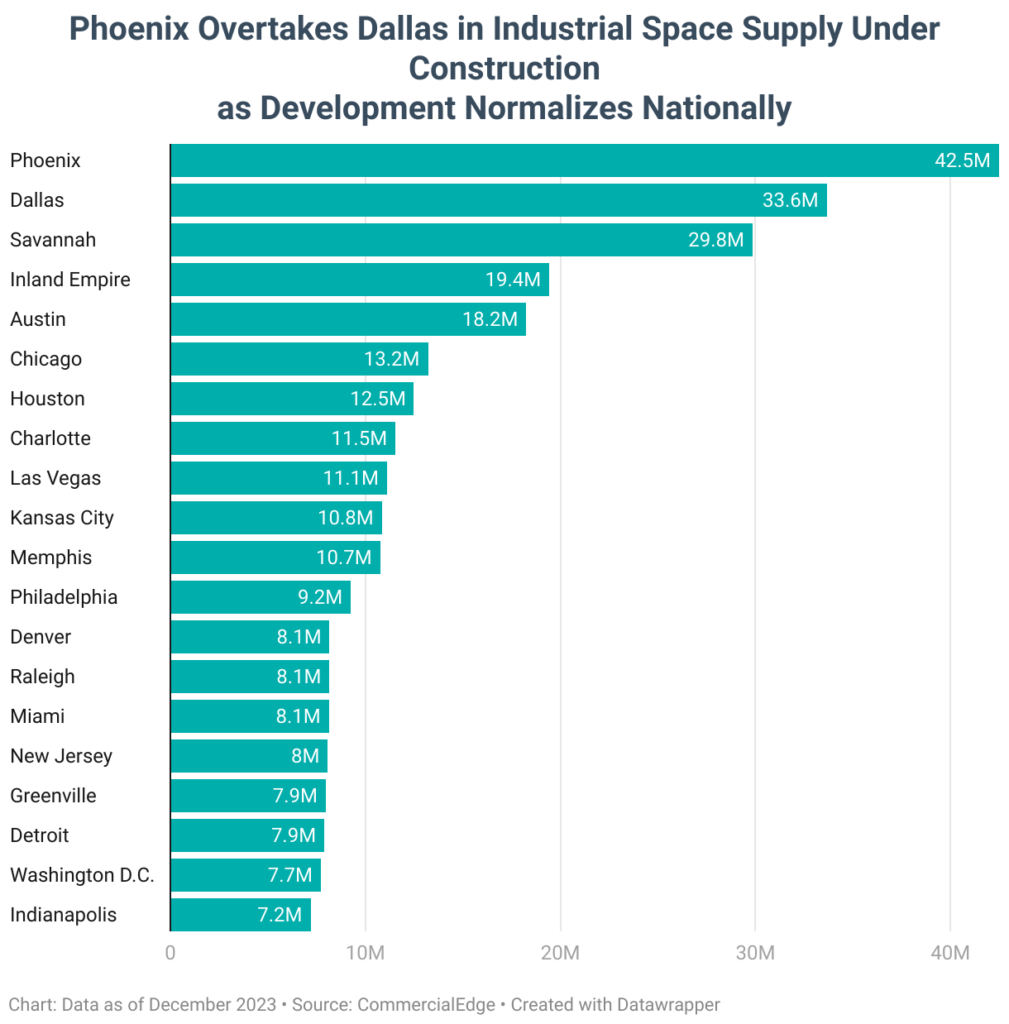

Phoenix Takes Center Stage as Industrial Market With Most Space Underway

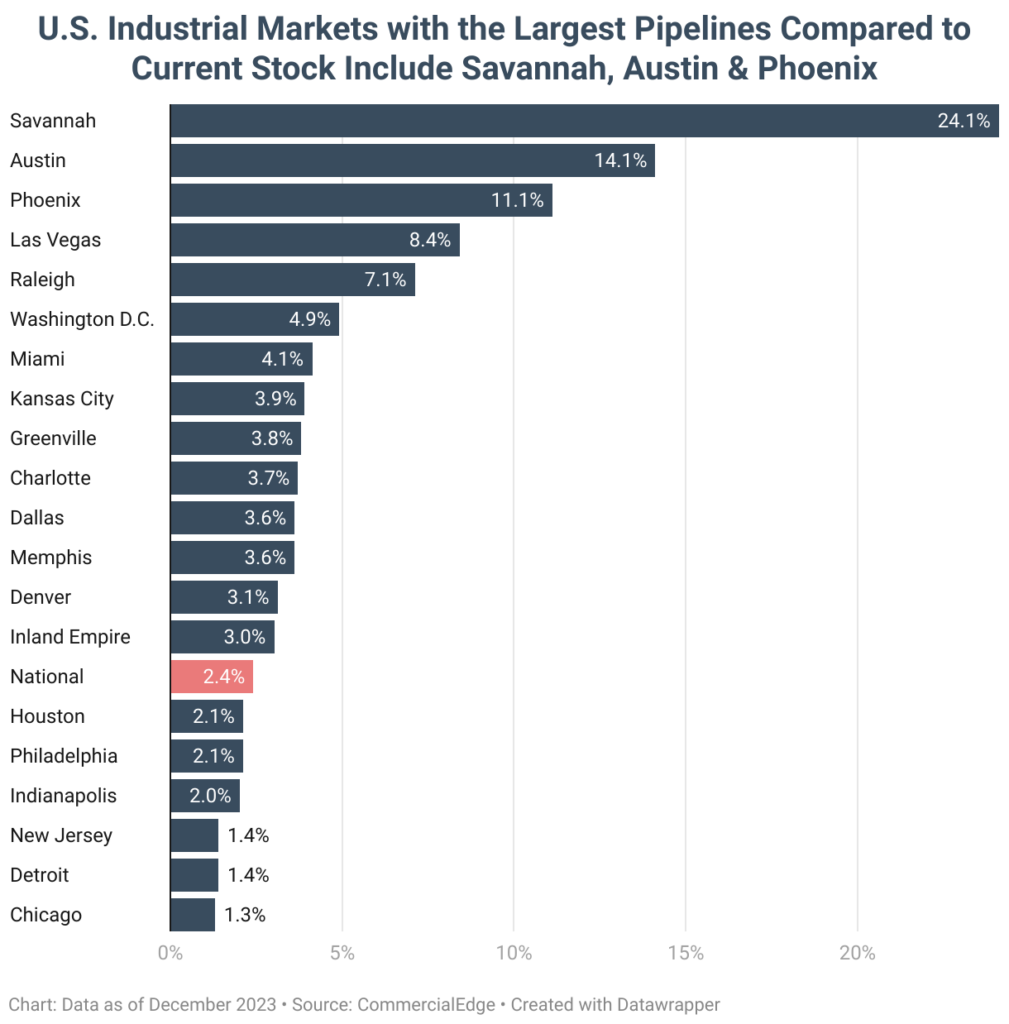

Phoenix has been recording accelerated industrial development for several years and has been counted among the fastest-growing industrial markets as a result. Now, in Q1 2024, the Phoenix market currently has the largest amount of industrial stock under construction at 42.5 million – ahead of markets with considerably larger inventories, such as Dallas and California’s Inland Empire. Even so, the square footage under construction here still represents a year-over-year decrease of around 18%, but the gap between new projects started in 2023 and completions in the same period was comparatively smaller in Phoenix, thereby granting the industrial market its first position in the standings when it comes to industrial development.

Meanwhile, industrial space under construction in Dallas is down 45% in Q1 2024 compared to Q1 2023, showcasing a more acute normalization of warehouse space development in the South’s largest industrial market. Still, the Dallas-Fort Worth Metroplex has a considerable 33.6 million square feet underway – the second-largest pipeline nationally and an increase of 3.6% to the market’s current stock.

Savannah boasts the third-largest industrial pipeline in the U.S. with 29.8 million square feet, including more than half in a single development: a Hyundai electric vehicle plant that’s also slated to be this year’s largest completion.

In recent years, Inland Empire – a Southern California market centered around San Bernardino and Riverside – was one of the fastest-growing industrial markets nationally, adding over 180 million square feet of industrial real estate between 2012 and 2021. Amidst global logistical difficulties that were made more acute by recurring delays in the Port of Los Angeles, the Inland Empire has quickly become a favorite for industrial development in the Greater LA area. Still, the market is now experiencing the same warehouse construction slowdown seen elsewhere with 19.4 million square feet of space currently underway – 10 million less than last year.

Another smaller-sized but fast-growing industrial market made it to No. 5. Austin, Texas, reached that spot due to its 18 million square feet of industrial supply underway. That places the market ahead of storied industrial markets such as Chicago (13 million square feet) and Houston (12.5 million square feet). Despite being only a fraction of the size of these markets – 130 million square feet in Austin compared to Houston’s 590 million and Chicago’s 1 billion – the Austin industrial real estate market is growing at a rapid pace driven by robust demand, especially for advanced manufacturing facilities that complement the city’s business environment. In fact, the current industrial stock underway in Austin is equal to 14% of the market’s current inventory, making it the second-fastest-growing market nationally.

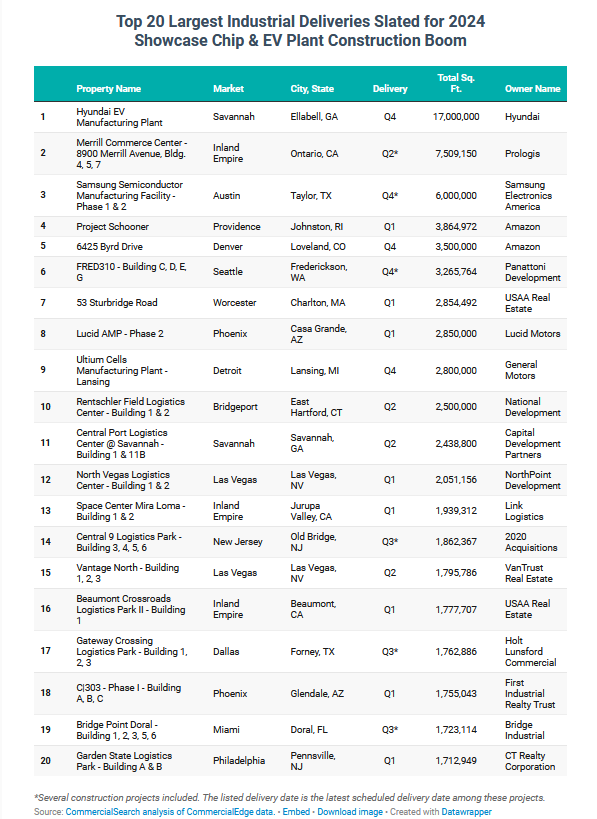

Largest Industrial Completions in 2024 to Feature Mix of Storage Facilities & Manufacturing Plants

This year, the largest completions stand to be a mix of manufacturing plants and multi-tenant storage and distribution facilities in industrial parks:

For several years, Amazon’s fulfillment and distribution centers made headlines as the largest industrial facilities being completed. However, as e-commerce sales plateaued and then fell close to pre-lockdown levels once again, the online retail giant hit the brakes on further logistics construction in 2022. At the same time, other retailers – online as well as brick-and-mortar companies looking to expand online – also reevaluated their storage and distribution needs. Consequently, construction starts for build-to-suit storage and distribution facilities slowed and such properties in the 2024 pipeline are mostly those that began during the heyday of logistics-driven construction.

Simultaneously, the effects of the CHIPS and Science Act and the Inflation Reduction Act of mid-2022 are becoming evident in this year’s pipeline of largest industrial completions. In fact, subsidies for onshoring electric vehicle and semiconductor production are contributing to a historical spike in manufacturing space construction. To that end, the largest industrial project this year stands to be Hyundai’s EV plant in Savannah, Georgia, clocking in 17 million square feet of industrial space across several facilities for the stamping, assembly and painting of electric vehicles. Other major EV plants in the pipeline include the second phase of Lucid Motor’s Phoenix facility (No. 8) and Ultium Cells’ battery plant in Detroit (No. 9).

Chip production plants also made the list with the foremost being Samsung’s semiconductor facility in Austin, Texas, in third place. Other chip plants will certainly follow suit as industry giants such as Qualcomm, TSMC, Intel and Micron all have U.S. facilities underway.

Distribution centers also made their presence felt on the list of 2024’s largest completions, including three buildings in Ontario, Calif.’s Merrill Commerce Center at No. 2 as well as two Amazon facilities at No.4 and No. 5, respectively. Still, the list is a far cry from 2023’s deliveries – when Amazon was responsible for six of the 10 largest properties nationwide – or 2022, when seven properties were by the e-commerce operator and an eighth was a Walmart distribution center.

Clearly, the 2024 pipeline showcases the first wave of the new state of industrial real estate construction: Normalized demand for storage and distribution is leading to a decrease in new construction starts, and warehouses being constructed are (to a larger extent) multi-building, multi-tenant properties in industrial parks, as opposed to single-tenant, build-to-suit distribution centers. At the same time, manufacturing is seeing increased focus as domestic production of electric vehicles and chips takes center stage.