By Maria Gatea

Self-storage construction has been on an upward trend since 2020 as the sector has become increasingly popular with American consumers, offering flexible solutions for life’s many transitions. While new construction has dominated the industry for decades, a significant shift is occurring: Existing industrial and retail buildings are being converted into self-storage facilities. This trend is not only optimizing urban real estate but also meeting the growing demand for storage in densely populated areas.

Conversions account for 9% of the country’s self-storage inventory

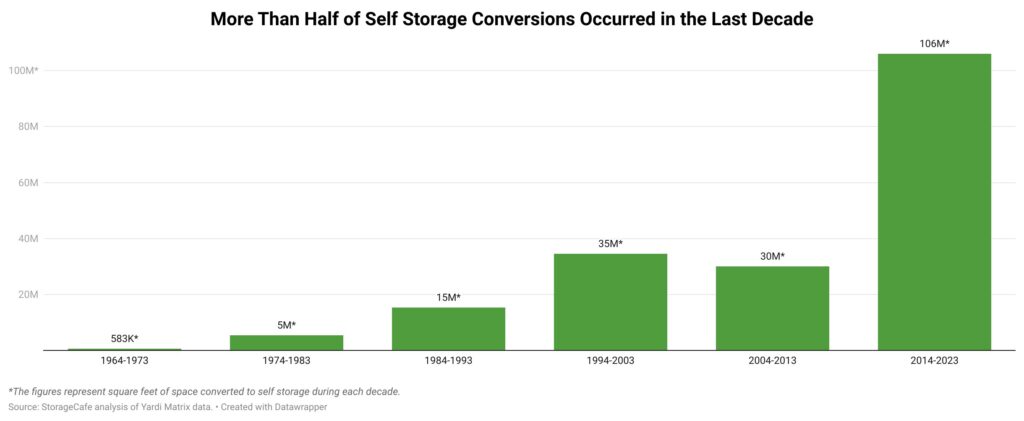

Approximately 9% of the U.S.’s total self-storage inventory – nearly 191 million square feet – now consists of converted spaces, according to recent StorageCafe research. These conversions are spread across more than 2,300 facilities nationwide, and more than half of these transformations have occurred in the past decade, signaling an acceleration of this practice, driven by urbanization and the scarcity of available land for new construction.

Converting existing buildings is often more cost-effective than building new facilities from the ground up, especially in urban areas where land acquisition and construction costs are prohibitively high. Developers can avoid zoning hurdles that often accompany new self-storage projects. The reuse of existing structures also aligns with sustainability goals by minimizing construction waste and reducing the carbon footprint associated with building materials.

Most of these converted facilities originated as industrial buildings. In fact, about 78% were previously used for industrial purposes such as factories and warehouses. Another 16% were formerly retail spaces like malls and big-box stores. The remaining conversions include office buildings, residential structures and other property types.

This repurposing not only breathes new life into dormant structures, but it also presents advantages for consumers. In about 46% of the more than 1,100 cities analyzed in this research, converted facilities offer better street rates.

Midwest and East Coast lead the way in conversions to self-storage

Cities in the Midwest and along the East Coast are at the forefront of this conversion trend. These regions, rich in historic industrial buildings, provide ample opportunities for repurposing. Urban centers like Chicago, New York City and Philadelphia have embraced conversions due to limited space for new developments and the high cost of land.

Chicago ranks first nationally for the adaptive reuse to self-storage of its formerly industrial and retail inventory, with 7.3 million square feet of repurposed space divided between 72 properties and amounting to almost half of the city’s total inventory. Other Midwestern cities with a penchant for conversions to self-storage include St. Louis; Milwaukee, Wisconsin; and Kansas City, Missouri. In St. Louis, the 2.2 million square feet of space converted to self-storage account for a massive 74% of the city’s overall self-storage inventory. Milwaukee registers 1.7 million square feet of converted self-storage space, which makes up almost half of the entire market. Kansas City, on the other hand, has 1.5 million square feet of converted self-storage space, or almost 40% of the total inventory.

NYC boroughs Brooklyn and Manhattan are very active on the conversions front as well, unsurprisingly so considering the chronic lack of space in the country’s busiest urban hot spot. About 4.6 million square feet of the self-storage space in Brooklyn are former industrial, retail and office buildings that have outlived their initial purpose. The converted self-storage represents 52% of the borough’s overall inventory. Even so, Brooklyn remains one of the country’s most undersupplied markets for self-storage, with just 1.65 square feet of inventory per capita, compared to a national benchmark of around seven square feet of self-storage space per capita.

The same rings true for Manhattan: The borough registers 4.4 million square feet of converted self-storage space, representing a massive three-quarters of the local inventory. The adaptive reuse efforts in Manhattan, albeit massive, are barely scratching the surface of local demand. Manhattan has only one square foot of self-storage space per capita, which naturally makes local street rates highly competitive; a standard unit here averages close to $240 per month, well above the national average hovering around $130 per month. The Bronx and Queens are also among the country’s top 10 most active cities in terms of adaptive reuse to self-storage, with 2.1 million square feet and 1.4 million square feet respectively.

As one of America’s historical industrial centers, Philadelphia has embraced the trend as well, transforming older factories and warehouses into self-storage to meet demand. The city features over 2.8 million square feet of self-storage space converted from old buildings, representing almost 36% of the local inventory.

The only two cities in the top 10 for adaptive reuse to self-storage that are neither Midwestern nor on the East Coast are Houston and Portland, Oregon. Houston, a relatively well-supplied market, managed to repurpose about 1.7 million square feet of old buildings to self-storage; however, this represents only 5% of the local inventory.

Portland, a former key hub for the manufacturing, shipping and timber industries and thus harboring plenty of vacant or underutilized commercial buildings, registers 1.5 million square feet of repurposed space – about a quarter of the city’s self-storage market.

As urban centers grow, adaptive reuse will continue to play a critical role in meeting the need for self-storage space in densely populated areas. From repurposed factories in the Midwest to industrial warehouses in New York City, self-storage conversions blend the preservation of older buildings, oftentimes part of valuable, historic industrial heritage, with modern utility.