By Maria Gatea

America’s apartment market is in the midst of an apartment building boom: 4.1 million multifamily units were delivered in the past decade alone (2015 to 2024) out of a total of 10.5 million apartments that came online since 1985. Yet while construction is hitting record highs, the apartments themselves are getting smaller.

Units built in the last 10 years are about 30 square feet smaller than those delivered between 2005 and 2014, and 75 square feet smaller than early 2000s ones. This shrinking trend, paired with the surge in new development, is pushing renters to find extra space elsewhere. Increasingly, that means turning to self storage.

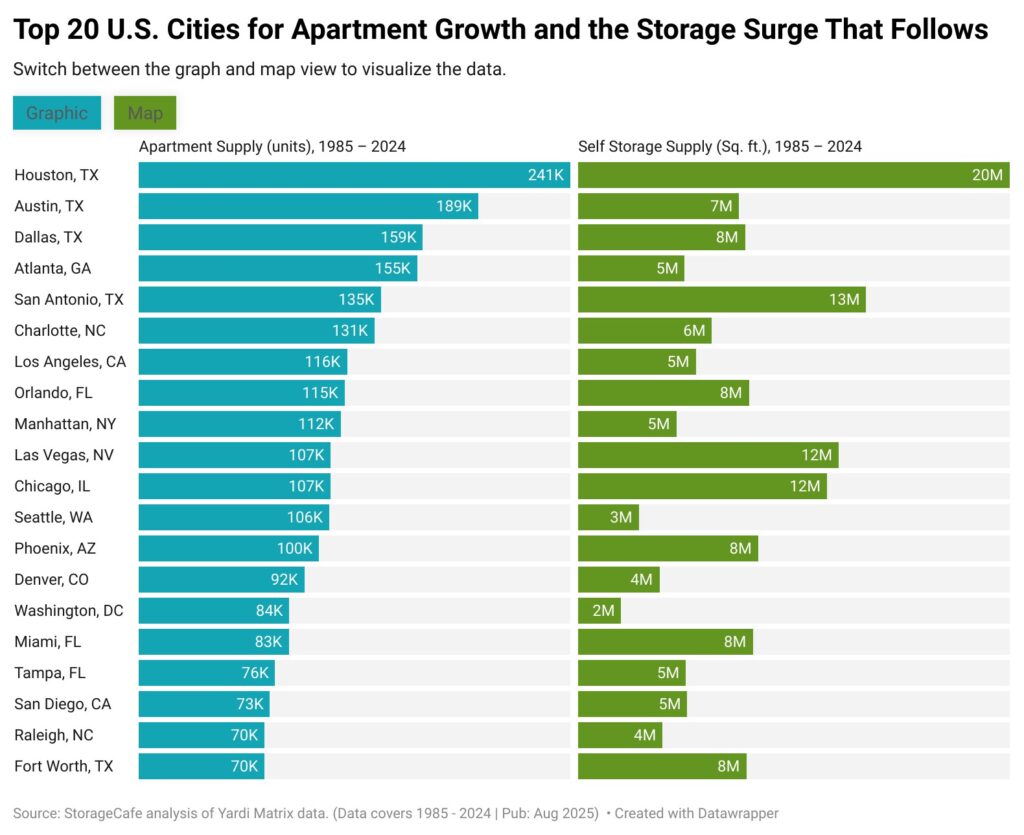

The storage industry has expanded by a remarkable 547 million square feet since 2015, bringing the national total to more than 2 billion square feet. StorageCafe’s analysis of 130 of the nation’s largest cities shows a tight correlation between apartment and self-storage construction. In places where more than half of today’s apartments were built since 1985, over 80% of the storage inventory was also delivered during the same period. In other words, self storage is not just keeping pace with apartment construction but has become an integral partner in supporting urban growth.

In the South, multifamily growth and self-storage construction move in lockstep

Nowhere is this convergence between apartment and self-storage construction more evident than in Sunbelt, particularly Texas. Houston has been a textbook case of the apartment-storage connection. Nearly half of the city’s apartments were delivered in the past 40 years, alongside an equally dramatic increase in storage space. Over 20 million square feet of storage was built during that time, representing 73% of its current inventory. In the past decade alone, more than 5 million additional square feet of self-storage space was added, precisely as new apartments were shrinking by about 44 square feet on average.

Austin offers a similarly compelling story. About 80% of its apartments have been built since 1985, with construction accelerating sharply in recent years. From 2015 to 2024, apartment deliveries grew by 160% while storage expansion more than tripled compared to the previous decade. Today’s Austin rentals are roughly 50 square feet smaller than those built in the early 2000s. Residents seeking minimalist, urban living styles often find that the only way to make it work is by leasing self-storage space nearby.

The South outside Texas mirrors the trend. In Atlanta, more than three-quarters of the current apartment stock has been delivered since 1985, yet newer units are getting progressively smaller. Those built between 2015 and 2024 are averaging just 900 square feet, a drop of 120 square feet compared to units built in the late 1990s and early 2000s. At the same time, about 5 million square feet of self storage has been added, much of it in the past decade. Even so, the city still offers only 4.5 square feet of storage per person, well below the national average of slightly over 7 square feet, leaving room for further expansion of the self-storage sector.

Apartment deliveries outpace self storage supply in California

On the West Coast, the apartment boom is just as pronounced, but self-storage construction has not always kept up. Los Angeles added more than 57,000 new apartments between 2015 and 2024, more than doubling the deliveries of the prior decade. Yet during the same period, self-storage deliveries, at over 1 million square feet, actually shrank by about 5% compared with the previous decade. With new apartments averaging just 779 square feet, about 37 smaller than those built between 2005 and 2014, Angelenos are now grappling with some of the tightest storage conditions in the country. There are only about 2 square feet of storage space available per person, resulting in monthly rents for the average storage unit that hover close to $290.

Seattle, by contrast, has seen self storage expansion more closely align with its multifamily surge. The city added 60,000 apartments in the past decade alone, most of them significantly smaller than previous units, averaging just 645 square feet. Storage development has responded quickly, with more than 1 million square feet delivered in the past decade, representing a 145% increase compared to the previous one. Additional projects are also scheduled to come online in 2025. For a market that grew its population by 16% over the past decade, the ability to balance multifamily growth with adequate self storage options has been key to accommodating new residents.

In the Mountain West, Las Vegas stands out as a city where apartments and storage have expanded almost in tandem. Since 1985, more than three-quarters of its apartments and over 85% of its storage inventory have been delivered, reflecting the city’s rapid population growth and suburban expansion. Unlike in some coastal markets where supply has lagged, Las Vegas shows how self storage can scale alongside multifamily developments to meet the needs of both long-term residents and a highly mobile population.

Self storage at a premium in dense urban centers on the East Coast, Midwest

In dense urban centers like Manhattan, the connection between shrinking apartments and limited storage is especially important. About one-third of the borough’s apartment stock has been added since 1985, and nearly all of its self storage (a whopping 95%) was also built in that time frame. Yet the supply remains far below what residents need. With only 1.2 square feet of self storage space per capita, average monthly rents push close to $250, making New York one of the costliest markets in the nation.

Chicago tells a similar story of imbalance. The city has added over 100,000 multifamily units since 1985, with half of them in the last decade alone, even as average apartment size has steadily declined. Storage development has increased, with more than 12 million square feet added in the past 10 years, representing a minor increase compared to the previous 10-year interval, despite the acceleration registered by multifamily construction. The city still offers just 3.5 square feet of self-storage space per person, half the national benchmark.

The nation’s apartment boom and the steady shrinking of newly delivered units are fueling parallel demand for self storage across a wide swath of U.S. cities. In some markets, particularly in the South and Mountain West, self-storage development has managed to keep pace, while in others, especially high-density coastal cities, supply shortages are driving up street rates and leaving residents with fewer storage options.

For the self-storage sector, this represents both a challenge and an opportunity. Developers and investors who focus on markets with strong multifamily growth and lagging self-storage supply stand to benefit from long-term demand. As renters continue to trade square footage for location and lifestyle, self storage is poised to cement its role not just as a convenience, but as a critical extension of modern apartment living.