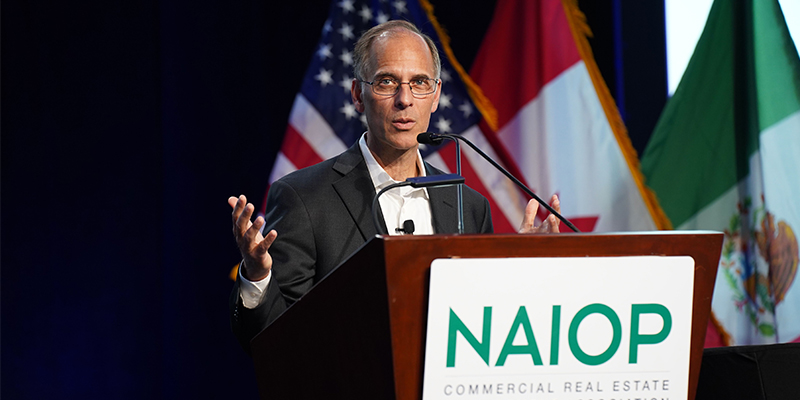

After a decade of emerging markets and economies dominating the global market, the tipping point has arrived: growth will begin to balance going forward. In his keynote remarks at CRE.Converge this week, Mark Zandi, chief economist, Moody’s Analytics, and co-founder, Moody’s Economy.com, explained why the stage is set for a U.S. turnaround as growth begins to accelerate and fiscal austerity and brinkmanship diminish.

“We’ve come a long way back since the depth of the downturn,” said Zandi. “We lost 22 million jobs in two months, and GDP fell 10% peak to trough.”

For context, in the 2008 financial crisis the GDP fell 4% peak to trough. “So that gives you a sense of the difference,” Zandi said. “Lowering interest rates by the Fed along with aggressive fiscal policy has been key to keeping the economy together.”

Zandi said the economy is getting back to full swing, and his baseline prediction for the next 18-24 months an optimistic one. He shared three key assumptions:

- The pandemic will continue to wind down. “We will likely suffer future waves of hospitalizations, but with each new wave, the disruptions to the economy will be less significant. Over the course of next 18-24 months, the pandemic doesn’t go away but largely fades away as far as its impact on our daily life.”

- Additional fiscal support will come through. Zandi pointed to the Build Back Better (BBB) agenda President Joe Biden has put forward. “I don’t know if the whole $3.5 trillion package will get through, but I think something will – maybe around $3 trillion over a three-year period. BBB spending will be helpful in keeping recovery on track, getting the economy back to full employment and help support future economic growth.”

- The Fed will slowly take its foot off the monetary accelerator. “I think the Fed will start tapering its quantitative easing probably in November, and by the end of next year they’ll have completely stopped buying bonds. As the economy comes into full employment, and unemployment is back to mid-3%, short-term interest rates will rise.”

Zandi also shared what he called an “upside surprise”: he sees major potential for productivity growth to accelerate coming out of the pandemic.

“Productivity growth has been very depressed since the financial crisis. Between WWII and the financial crisis, growth was about 2% per annum. After the financial crisis, growth fell to about 1% per annum.”

Zandi anticipates increased investment around labor-saving technology, and aggressive investment in labor-saving software and hardware to get around the constraints on labor supply.

One of the key weights on productive growth has been the age of the workforce – specifically baby boomers – he added.

Zandi initially held what he called a “wise man theory,” that when an older worker left their job, everyone left behind was diminished by their departure because they took so much institutional knowledge with them. However, Zandi came to realize another theory was correct – what he called the “albatross theory,” where in fact the older generation of workers hold back the younger workers from reaching their full potential.

“Many baby boomers retired – or were forced out – during the pandemic, and they are not coming back. So that might allow for productivity growth to increase,” he said.

“If we go from 1% productivity growth back up to the pre-financial crisis level of 2% growth, that has tremendous implications,” Zandi pointed out.

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s CRE.Converge 2021. Learn more about JLL at www.us.jll.com or www.jll.ca.