How many different commercial areas in your market are in transition? Maybe a professional or minor league sports team is considering a new mixed-use development, or an industrial area is attracting a growing residential community. On the flip side, perhaps the nearby office campus sits partially empty, or the local mall cannot attract shoppers the way it once had. These changes are familiar market landscapes to commercial real estate professionals, but they may not be as familiar with the tools to help maneuver these transitions.

One such tool can channel the voices and dollars of commercial real estate owners to great effect. Known as special purpose districts, special service districts, or a host of other names, special districts harness resources that benefit a variety of commercial centers.

Outlining Special Districts

Special districts are independent units of government created for special purposes and vary from state to state. Many are public-private partnerships, where landowners, businesses and governments work together through these legislatively-enabled organizations. These public-private partnerships focus on providing transportation, public safety, water and much more. Benefits, such as enhanced property and portfolio performance, are accrued through the capital projects and services the district provides.

Special districts are used in a variety of asset classes, including retail centers, office parks, industrial parks and other areas. Depending on the type of special district, the processes to form them differ. Many districts, like Business Improvement Districts (BIDs) throughout the country, require the consent of commercial property owners, whereas others, like Special Services Districts (SSDs) in Georgia, do not require consent. For districts that require property owner consent, interested parties should educate fellow owners to build consensus about the district. Generally, for those interested in creating a special district, building relationships with public officials is critical since the district must be approved by the government in one way or another.

Special districts essentially channel funds into the district. One way that funds are raised is through property assessments; another is by attracting government grants. Property or facility owners are incentivized because resources pooled through special districts collectively attract larger sums of government grants. These funds build, repair, or maintain infrastructure and services important to commercial landowners. Special districts are frequently used to help finance shifting commercial markets, such as those illustrated by the following examples:

Special Districts that Support Stadium-anchored Mixed-use Developments

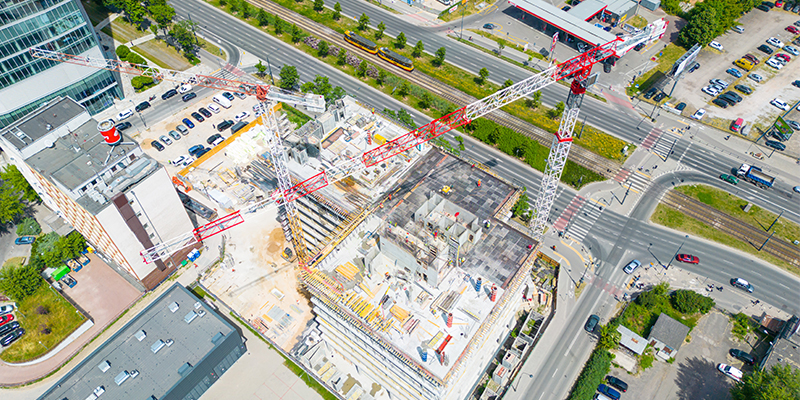

Sports organizations, from professional and minor league teams to universities, are expanding their real estate footprints, allowing them to diversify revenue streams and grow portfolios. Earlier this year, Sports Business Journal reported that more than 280 stadium and arena projects, representing $31.4 billion in total construction costs, are scheduled to finish in 2025 and beyond.

Both Washington and Wisconsin have professional ballpark districts to support their major league teams. The districts were instrumental to the Seattle Mariners and the Milwaukee Brewers in their early stadium development. As the local neighborhoods evolve and the teams eye development opportunities surrounding the stadiums, these districts will continue to play major roles.

At the college level, Arizona State University’s athletic facilities district in Tempe was formed to help the university maintain and improve its athletic facilities, including parking. This athletic facilities district has also supported other asset classes, as it has been integral to the growth of the Novus Innovation Corridor, an urban mixed-use development adjacent to the university’s campus.

Special Districts that Support Evolving Industrial Areas

A municipal services district in Charlotte, North Carolina, supports the city’s evolving South End neighborhood. Once an industrial corridor, the neighborhood is now a thriving multi-use community. The municipal services district focuses on managing public spaces, advocating for economic growth, and promoting the area to pave the way for a diverse and creative community. In the last two years, more than 2,500 new residential units have been added, property values have increased 10%, and CRE has experienced a 15% year-over-year increase in new businesses.

The Northern Liberties BID in Philadelphia is a former manufacturing district that today attracts a diverse community. Through the BID, CRE owners benefit from efficient marketing and capital improvement efforts that sustain a 20th-century industrial aesthetic that draws crowds and economic growth.

Special Districts that Support Single-use to Mixed-use Developments

With the persistence of remote and hybrid work options, coupled with the continued resistance to traditional office environments, mixed-use developments have been on the rise for some time. As a result, monofunctional developments such as indoor megamalls and office campuses face reinvention. Without complementary real estate products, attractive amenities, and interesting experiences, these real estate products find it increasingly hard to compete. Owners and developers in these transitioning areas are also tapping into special districts.

Metro Atlanta’s Gwinnett Place Mall is a shuttered, enclosed shopping center. For years, local businesses and commercial property owners watched the 39-acre parcel decline. Through the Gwinnett Place Community Improvement District, local stakeholders advocated for the county government’s purchase of the dying mall property and further investment in revitalization. In May, Bisnow reported that the effort has identified 50,000 square feet of office space, 55,000 square feet of new retail, a 50,000-square-foot cultural center, and nearly 13 acres of parkland. Through this special district, stakeholders are envisioning, repositioning and adding value to one of the commercial area’s most important parcels.

Special Districts that Support Port Cities

Consumers’ ever-increasing appetite for goods fuels the nation’s more than 300 ports and their surrounding regions. Once again, special districts often support these economic hubs. Seattle’s Waterfront district is a large-scale redevelopment effort centered on better street connectivity, bike paths, streetscapes and more. These improvements are being advanced through the Waterfront Local Improvement District, which has liaised with the city and state to seek funding and implement its redevelopment strategies.

Cedar Port in Houston is a fast-growing port. The Cedar Port Navigation and Improvement District recently attracted a $10.9 million federal award to make needed improvements for tenants. Most port cities rely on utility-focused special districts that ensure businesses remain sustainable and goods move smoothly.

Lessons Learned

- Special districts excel at organizing, scoping, prioritizing, advocating and financing, giving CRE owners and developers a competitive advantage over areas that do not have special districts.

- Special districts can increase the amount of available capital for public infrastructure improvements. By pooling an initial tranche of funds, owners and developers participating in community improvement districts and business improvement districts can attract larger amounts of government grants and loans that pay for needed infrastructure.

- Special districts foster collaboration between the CRE owners, developers, and government partners, giving investors a seat at the table to help guide public policies and investments that impact their developments and portfolios.

- Special districts can play a major role in supporting tomorrow’s development needs. From electric vehicle charging stations and stormwater management to data center concentration, special districts can be tailored to upcoming commercial centers to provide value and opportunity through evolving landscapes.

- With tens of thousands of special districts across every state, owners and developers have access to information and best practices to help with their unique needs. This knowledge-sharing allows outside-the-box thinking in times of market transition.