By Maria Gatea

U.S. cities have experienced massive expansion across all real estate sectors over the past 44 years, according to recent StorageCafe research that looked at residential and commercial construction activity between 1980 and 2023.

Along with residential construction, industrial, office, retail and self-storage spaces have grown significantly, although the scale and pace of development differ among regions and asset types.

Industrial real estate boom, driven by e-commerce and manufacturing revival

Almost 29.3 billion square feet of industrial space have been delivered across the United States since 1980, representing about half of the country’s overall inventory.

In recent years, the demand for industrial real estate has reached new heights, with distribution centers, warehouses and manufacturing sites emerging as in-demand assets. Companies have required more logistical centers to support inventory and facilitate efficient delivery processes, while the resurgence in domestic manufacturing has also fueled industrial construction.

Consequently, since 2020, industrial real estate construction has averaged a remarkable 516 million square feet annually – more than double the rate of the 2010s and surpassing every decade since 1980.

Houston, a longtime industrial hub, ranks first nationally for industrial inventory expansion, having added almost 292 million square feet of industrial space since 1980, with the current decade also seeing record growth. Fellow Texan city Fort Worth has contributed an additional 138 million square feet of industrial real estate, while Phoenix is rapidly expanding as well, having delivered 127 million square feet of new space over the past five decades.

Office construction is adapting to a hybrid workforce

Office construction is in for some transformative changes – overall, this sector delivered 12.6 billion square feet of space between 1980 and 2023, amounting to 55% of the national inventory. However, evolving work models and the impact of the COVID-19 pandemic are jump-starting a major overhaul of how offices are being designed and built.

Office space development peaked in the 1980s, with over 268 million square feet delivered annually, largely in response to the growing corporate and financial sectors. While office construction dropped significantly in subsequent decades, this segment has demonstrated remarkable adaptability, now focusing on creating flexible workspaces that accommodate hybrid work models. The 2020s, though subdued compared to the past, still see notable office construction, with over 86 million square feet of new space going online annually.

Looking at cities that excel in office construction, New York City is in a leading position, having added over 255 million square feet office space. Second in line is Houston, with 170 million square feet of office space built since 1980, followed by Atlanta, which punches well above its weight with over 108 million square feet.

Rising demand across urban centers has led to a massive expansion of the self-storage inventory

Self storage has emerged as one of the fastest-growing real estate sectors over the past five decades, driven by shifting lifestyle trends, urbanization and the need for flexible storage solutions. Since 1980, the self-storage industry has added nearly 2 billion square feet of space, representing a whopping 91% of the existing inventory. Currently, the sector is on track to deliver over 64 million square feet annually, potentially making the 2020s the most active decade yet for self-storage development.

The rising popularity of self-storage is partially due to increased urban living, where smaller apartments and condos limit storage capacity. Moreover, the mobility of today’s workforce has heightened demand for flexible, off-site storage options. Houston leads the nation in self-storage construction, with over 26.6 million square feet of new storage space added since 1980, reflecting the city’s population growth and influx of newcomers.

New York City also shines in this category, having delivered nearly 45 million square feet of self-storage space, with residential density and space constraints creating strong demand. San Antonio ranks third nationally for self-storage construction, counting 17 million square feet of space that have come online since 1980.

The rise of e-commerce dampens retail construction

Retail development has taken a more moderate path, with its growth trajectory shaped by online shopping and market consolidation. During the 2000s, retail construction peaked, delivering 246 million square feet annually. But as e-commerce gained ground, physical retail demand shifted, leading developers to focus on locations with high consumer foot traffic and strong community engagement. Presently, about 56.6 million square feet of new retail space are being delivered annually at a national level, making the 2020s the slowest decade since 1980 in terms of deliveries in the sector.

The top three cities for retail construction over the past half-century include Houston, San Antonio and Las Vegas.

Sunbelt and Southwestern cities are front and center for overall construction activity

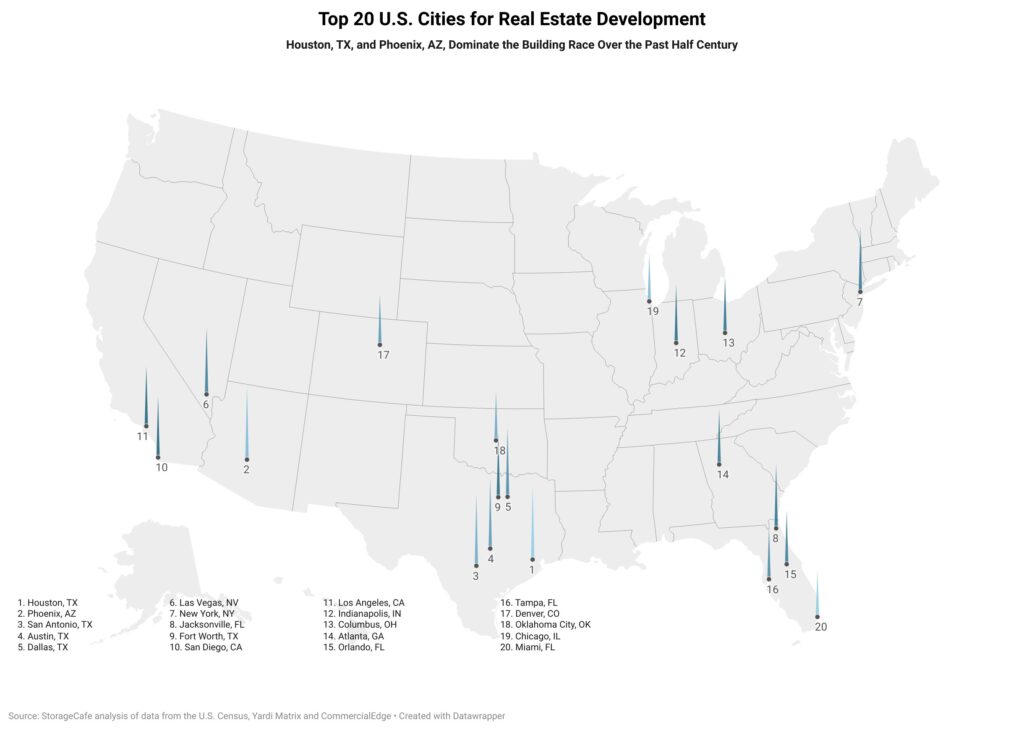

Sunbelt and southwestern cities have dominated the overall real estate development Olympics over the past five decades, with 15 of the top 20 fastest-growing cities located in these regions. Favorable tax structures, lower cost of living and thriving job markets in sectors like energy, health care and technology have made these areas attractive to both residents and businesses. This naturally stimulated construction activity, helping the regions push ahead in terms of real estate development, both residential and commercial.

Houston ranks first in overall real estate development from 1980 to 2023, exemplifying this trend, with massive gains in all real estate sectors. Phoenix and San Antonio round out the podium, managing to drastically reshape their real estate landscapes during the same period.

Other Texan cities, namely Austin, Dallas and Fort Worth, are ranking high in the top, alongside an entire host of other southern and southwestern cities, including Las Vegas; Jacksonville, Florida; San Diego and Los Angeles.

New York City, the country’s largest city by population, lands seventh for the overall volume of residential and commercial real estate built here since 1980. The best-ranking Midwestern cities are Indianapolis; and Columbus, Ohio, with Oklahoma City and Chicago also landing in the top 20.