By Michael Plumb

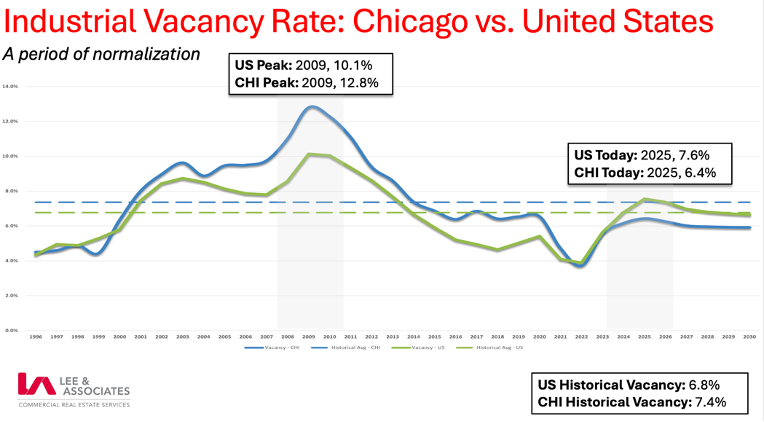

A recent Wall St. Journal article reported that the U.S. industrial real estate sector has struggled for the past three years, reaching an 11-year high of 7.6% nationally – causing owners, investors and developers to take pause. But the numbers don’t always tell the full story. In fact, many U.S. industrial real estate markets are reverting to their historically healthy levels of supply and demand.

The cyclical nature of industrial real estate development can sound false alarm bells. It’s simply a case of supply not being as fluid as the needs of users. Acquisition and financing challenges, lengthy entitlement periods, construction timelines, weather and supply chain considerations can all temporarily drag down industrial market fundamentals.

How the cyclical nature of industrial can fool us

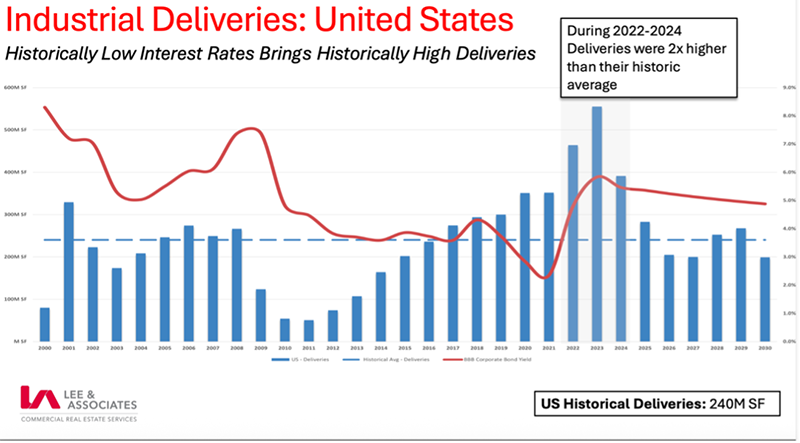

Many major U.S. industrial markets saw massive amounts of new construction deliveries during the COVID-19 pandemic, and the resulting excess supply has played a starring role in the misguided narrative that industrial is struggling. According to Lee & Associates’ Q2 North America Industrial Market report, the inventory of logistics buildings between 100,000 and 500,000 square feet in the U.S. has grown by 14% since 2021. Concern over the impact of tariffs has slowed down tenant growth in logistics, adding another layer of complexity to the industrial story. Nationally, new deliveries are still outpacing tenant expansions.

Generally speaking, the industrial sector lags the overall economy and is slower to respond to shifts in demand. In Chicago – the nation’s largest industrial market with more than 1.4 billion square feet of inventory – the entitlement process alone can range from 4-6 months on a typical timeline and 12 months or more when a rezoning or complex infrastructure upgrade is involved.

Reverting to the “norm”

However, it’s important to take a breath, and note that nationally, this “unprecedented” level of industrial real estate vacancy is just slightly higher than the long-term historical average of 6.8%. Markets like Chicago – despite some challenges like weather and construction timelines – can adapt to market shifts better and faster than others, mostly due to a combination of infrastructure, institutional investment presence, regulatory environment and developer sophistication. Chicago historically fares very well due to its status as the largest rail hub in North America, trucking and air cargo infrastructure and diverse industries. This major metro claimed a 6.4% vacancy rate in the second quarter, which is well below the current U.S. average, and still far below the Chicago historical vacancy of 7.4%.

No crystal balls, but history predicts future performance

With low industrial inventory plaguing the U.S. for several years, necessitating new construction, it has been difficult for investors and developers to time the cyclical nature of the real estate market and arrive at perfect supply-demand equilibrium. But if history tells us anything, it’s that the industrial sector has its share of peaks and valleys – not crashes. Even in major downturns like 2008 and 2020, industrial was proven to be one of the most resilient asset classes.

Today, the reality is that industrial real estate is reverting to normal, and more sustainable, demand and occupancy levels. Once excess product is absorbed and interest rates settle, vacancy rates are expected to further stabilize in many markets. Moderate rent growth due to the significantly reduced construction pipelines will likely follow.