Adaptive reuse projects surged to historic levels in 2024. Nearly 25,000 apartments were completed from converted structures across the U.S., a 50% jump over 2023 and double the total in 2022, a RentCafe.com report shows.

The trend shows no sign of slowing. Another 181,000 apartments are currently in the pipeline, most from former office buildings, reflecting how developers are reimagining obsolete spaces to meet housing demand.

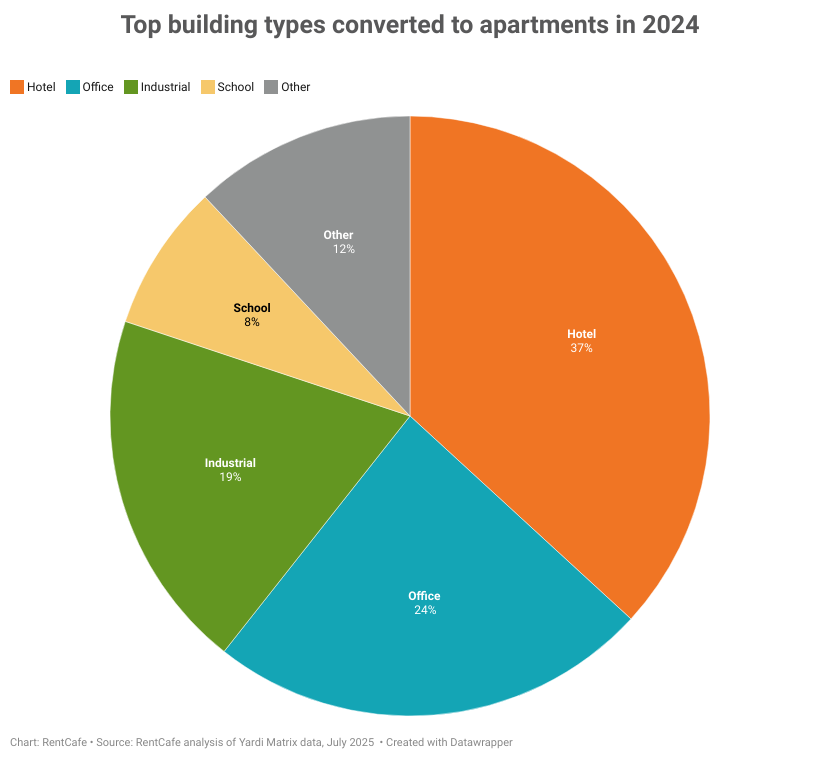

HOTELS DOMINATE, OFFICES FOLLOW CLOSELY

Hotels once again led the charge in adaptive reuse. More than 9,100 new apartments came from converted hotels in 2024, representing 37% of all reuse projects – a 46% increase from the year before.

This shift stems from ongoing pressure on the hospitality sector: slimmer margins, rising costs, slow recovery in travel, and looming debt. Many owners opted to sell or repurpose underperforming hotels, especially Class B and C properties, which made up 93% of last year’s conversions.

Meanwhile, office-to-apartment projects accounted for nearly a quarter of new units. That amounts to about 5,900 apartments, up 34% year over year. Interestingly, seven out of 10 projects came from Class A office buildings, which are easier to adapt thanks to modern layouts and infrastructure. These premium conversions often target renters seeking upscale city living.

Other categories saw growth as well. For example, industrial buildings contributed roughly 20% of new units, while schools – the fastest-growing segment – accounted for nearly 8%. About 2,000 apartments came from former educational facilities, four times the 2023 total. Falling enrollment numbers and the high costs of maintaining old school buildings have made conversion an appealing solution in many urban areas.

CHICAGO TAKES THE CROWN FROM MANHATTAN

For the first time, Chicago topped the list of cities with the most new apartments from adaptive reuse, surpassing Manhattan. The Windy City delivered 880 apartments across four major projects, including the conversion of a historic Sears store into 206 apartments.

The Chicago city government has been proactive in promoting adaptive reuse, particularly in the LaSalle Corridor of the Loop, where incentivized redevelopment programs aim to produce 1,000 mixed-income apartments, one-third of which will be affordable.

Denver came in second with 789 new apartments, more than double the total in 2023. Its Adaptive Reuse Pilot Program encourages office-to-residential conversions in the downtown area, supported by the upcoming state tax credits beginning in 2026.

Philadelphia followed with 761 units, highlighted by The Battery, a landmark 1920s riverfront power company building transformed into lofts with coworking spaces and a rooftop pool.

In Dallas, three major projects delivered 698 apartments, including the Peridot Residences – a $40 million conversion of the 50-story Santander Tower downtown.

Manhattan, last year’s leader, slipped to fifth place despite completing 588 apartments, all part of Pearl House, one of New York’s largest office-to-residential conversions to date.

Every city in the top 10 delivered more than 500 units, a significant increase from the prior year, when most topped out at nearly 300.

BALTIMORE LEADS IN HOTEL CONVERSIONS, MANHATTAN STILL RULES OFFICES

In the hospitality sector, Baltimore led the nation thanks to the conversion of two aging hotels – the Holiday Inn and Radisson – into 550 apartments, marking 2024’s largest hotel transformation.

Next, two Florida cities showed strong performance. Kissimmee, near Disney World, added 500 apartments from hotel conversions, addressing both surplus lodging and local housing needs. The city has another 500 units underway, making it the top market for upcoming hotel-to-apartment projects.

The second is Jacksonville, where hotel transformations created 423 new apartments in 2024, aided by flexible zoning and municipal incentives. One notable project, Elevate at Baymeadows, turned a two-story Day’s Inn into 107 modern rentals.

Office conversions remained robust in Texas and the Midwest, though Manhattan retained its office conversion crown. Its standout project, Pearl House at 160 Water Street, turned a 1970s tower into 588 apartments with five new floors added – a collaboration between Vanbarton Group and Gensler.

Nearby, White Plains, New York, delivered 468 apartments by transforming a 1960s AT&T office into modern housing. Dallas followed with two major towers – Peridot Residences (291 units) and The Sinclair (293 units) – that together reshaped the downtown skyline. Houston ranked fourth after repurposing a downtown office tower into Elev8, offering 372 apartments, ranked among the nation’s largest office conversions.

The Midwest also saw strong participation, with Cleveland, Detroit, Minneapolis and Cincinnati each delivering between 200 and 367 units from office conversions.

THE PIPELINE: 181,000 UPCOMING APARTMENTS

The boom is far from over. Nationwide, nearly 181,000 apartments are now in various stages of redevelopment – up 19% from 2024’s pipeline.

Offices dominate future projects, representing 43% of upcoming conversions, or about 78,400 apartments across 430 buildings. Manhattan again leads with 9,000 office units planned, signaling a shift toward transforming aging commercial towers into livable spaces.

Hotels remain the second-largest category, with 35,800 apartments – or 20% of all future projects– set to emerge from former lodging properties. Manhattan is also poised to lead here, with seven new hotel conversions expected to yield over 1,700 apartments.

Industrial spaces make up another 17%, led by Buffalo, New York, which plans to deliver 1,250 apartments through the transformation of 10 warehouses and factories.

At the city level, Manhattan tops the national list for future conversions with 11,000 units, followed by Los Angeles (5,640) and Chicago (5,000). Rounding out the top 10 are Washington, D.C.; Philadelphia; Denver; Brooklyn, New York; Atlanta; and Dallas, which are all turning underused spaces into new rental options.

The adaptive reuse boom reflects broader shifts in how cities respond to post-pandemic realities – vacant offices, struggling hotels and a persistent housing shortage. Developers, investors and local governments are increasingly working together to reimagine these spaces as attractive communities.

For more insights and a detailed methodology, read the full report on RentCafe.com