Citing progress on inflation and the balance of risks, last week the Federal Reserve announced rate cuts of 0.5%, to 4.75% to 5%. Can we expect additional cuts from the Federal Reserve and when, and how would these cuts impact commercial real estate markets?

How deep are the cuts?

According to data from the Fed, on Sept. 20, Treasuries were trading as follows:

- 1-month Treasury 4.87%

- 3-month Treasury 4.75%

- 6-month Treasury 4.43%

- 1-year Treasury 3.92%

After some math, we can use these yields to compute market participants’ beliefs on future Fed actions as follows: 25bp rate cut on Nov. 7, 50bp rate cut on Dec 18. and 75bp rate cut on March 19. In sum, markets are expecting the Fed to cut rates by 1.5% over the next 6 months, and if that occurs, the Fed funds rate will fall from 4.75% to 3.25%.

Are markets correct?

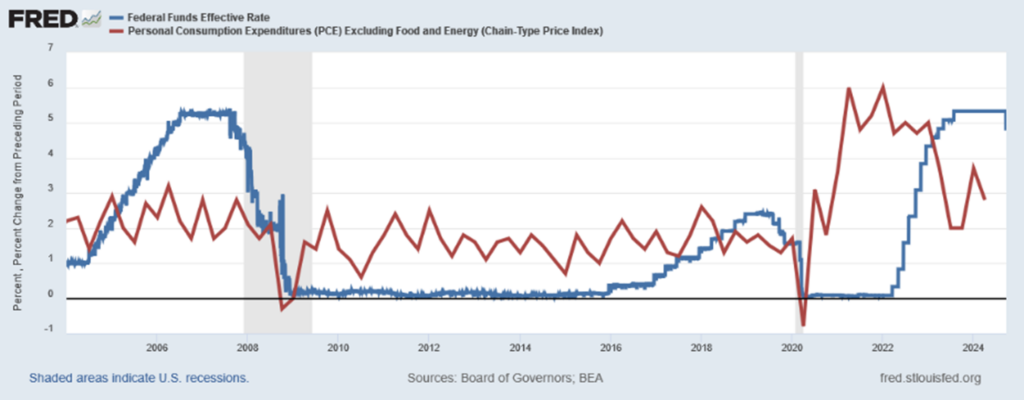

The Federal Reserve has two mandates when setting rates: full employment and price stability. The figure below shows the past 20 years of data for the Fed Funds rate (blue) and a measure of the annual inflation rate (red) and recessions are indicated by the shaded grey bars. If you focus on the 2020-2022 period, you can see that inflation jumped from about 2 to 5%, at which point the Fed raised interest rates from 0 to about 5%. Now that inflation has fallen – but not yet to a sustained “target” of 2% – the Fed has started to cut rates.

The figure shows that you have to look at data prior to the 2008 to see a prolonged period where the Fed funds rate was larger than 3%. Of course, 2008 was a long time ago and a lot has happened since then. If we draw from recent data and think that 2018 and 2019 were “normal” years where the economy was healthy but not crazy and inflation was contained, then the Fed Funds rate during those years suggests we should expect the Fed to ultimately lower the Fed Funds rate to approximately 2%.

The impact to real estate

The increase in the Fed Funds rate from 0 to 5% created a very stressful situation for banks. The increase in the Fed Funds rate pushed up the cost to banks to service their short-term debt and deposits but did not (immediately) change the income banks receive on their existing stock of loans and other assets. This reduced bank profitability. Banks responded to a decline in their profits and an increase in their cost of funds by tightening credit standards (higher loan-to-values (LTVs), higher debt-service coverage ratio (DSCRs)) and charging higher interest rates on construction loans and commercial mortgages. This had an immediate impact on our sector: Projects no longer penciled out, deals fell through, developments under construction were abandoned, prices fell and transaction volume declined.

As the Fed reduces rates, we should expect the exact opposite to occur. Bank profitability will rise, freeing up cash to banks and enabling banks to make more loans. The loans they make will have lower DSCRs, higher LTVs and lower interest rates. The availability of more plentiful and cheaper finance to the sector will enable firms to bid more aggressively for deals, pushing up prices and transaction volumes. All in all, the decline in rates will be good for commercial real estate.

The risks

There are two key risks to a rosy future for commercial real estate brought on by cheap and plentiful finance. The first risk is that inflation may remain higher than 2%, the unwritten Fed target. If inflation hovers at say 3%, the Fed may wish to keep rates high until it concretely sees a sustained period of inflation at or below 2%. This will delay Fed loosening.

The second risk is that something bad happens that triggers a recession. In this scenario, we should expect aggressive and large Fed rate cuts, possibly to 0. Even with a large cut in rates, a recession isn’t good for commercial real estate: household incomes fall and spending drops. These factors negatively affect rents that businesses are willing to pay and therefore commercial real estate valuations.

A lot can happen between now and the Fed’s next scheduled meeting, Nov. 6-7, including the presidential election that very week. We’ll see if my predictions hold true and what it all means for commercial real estate.