The post-recession economic revival is well underway, supporting the revitalization of most commercial real estate sectors, but evolving demand drivers have structurally changed the industry’s investment outlook. As elevated market liquidity and low interest rates align with changes in the marketplace, investors have adapted their strategies, dramatically altering the commercial real estate investment landscape.

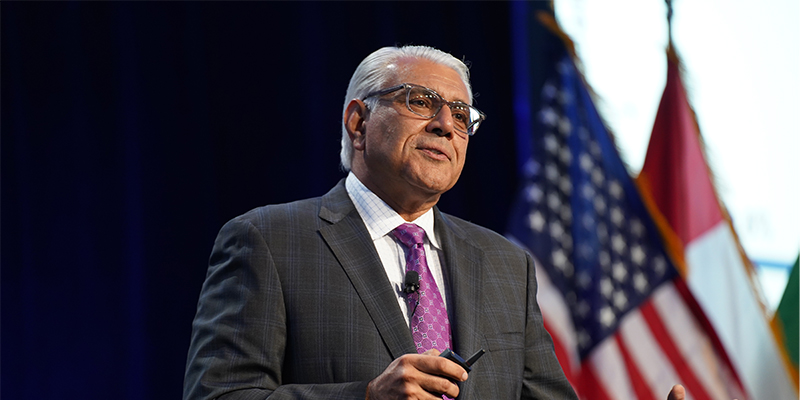

At CRE.Converge this week, Marcus & Millichap President and CEO Hessam Nadji covered a lot of ground on these topics and much more.

The U.S. economic recovery is well underway, Nadji said. “Unlike the 2008 financial crisis, we had a healthy economy and a banking system flush with cash when the pandemic hit, and the stimulus was significantly bigger and it came a lot faster.”

In seven weeks, the U.S. had an injection of about 25% of its GDP via government-funded stimulus packages. Compare that to the 13 months it took for a stimulus in 2008-2009, which was just 6.5% of GDP at the time.

Nadji also pointed to the $5 trillion of unspent capital that has been accumulating in the form of U.S. savings deposits and money market mutual funds since February 2020 – all money that will eventually come back into the economy.

“We saw a surge [in consumer spending] when we started to see the pandemic lift, then a slight pullback when Delta [variant] emerged. It’s been choppy. But let this be an indication of how much momentum there is ahead of us.”

Nadji shared data demonstrating that Q2 2021 was a record-setting quarter for commercial real estate transaction volume. “There is motivation to sell, motivation to buy,” he said, though property performance, valuation and outlook varies by segment.

He shared a chart divided into several subsectors of commercial real estate, ranked from green to red, with green being the most healthy and dark red being most at risk. In green were warehouse/distribution, suburban multifamily and life science/biotech. In the red (and declining) were suburban office and urban office, with lower-tier shopping centers at the bottom of the chart.

“This doesn’t mean capital isn’t flowing to these segments,” Nadji clarified. “I’ve never seen as much demand for the full spectrum of assets. Because people are looking long-term.”

While it won’t stay as red-hot as it is today, the fundamental drivers of deal activity and capital coming into commercial real estate will stay supported, Nadji predicted.

“Don’t underestimate the power of interest rates and how they can be leveraged. The current broad-based downward pressure on cap rates is a result of two things: the incredibly low cost of debt and the resounding release of pent-up demand, supporting job growth and economic expansion.”

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s CRE.Converge 2021. Learn more about JLL at www.us.jll.com or www.jll.ca.