By: Kathryn Atkins

Cold storage could be a tempting hot spot for hungry CRE investors, agreed panelists at I.CON West this week in Los Angeles. Marty Khait, co-founder, Yukon Real Estate Partners; Kate Lyle, NCARB, principal, Lamar Johnson Collaborative; and Sage Rheinschild, Cold Storage – Food & Beverage Specialist, JLL, shared their perspectives on the risks and strategies in optimizing cold storage in existing buildings.

When end-users need refrigerated or frozen space or are priced out of a new ground-up development, they often turn to leasing existing industrial buildings. However, existing industrial buildings come with their own challenges, not the least of which is being able to match the existing usage of the building to the specificity that an end user requires. Retrofitting an existing structure may not be the most cost-effective in the final analysis.

The panelists discussed design basics distinguishing temperature-controlled facilities from a typical cold storage facility. It’s a relatively straight path from “farm to table,” yet end users outside cold storage operators vary widely. The risks inherent in a possible multitude of failures along the path create what Rheinschild called “the disappointment of spoiled raspberries the day after you bring them home from the grocery store.” She continued, “These types of critical path failures result in as much as 40% of produce being thrown away in this country.”

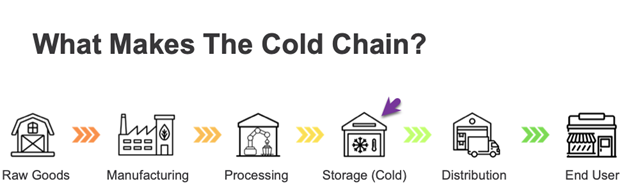

What Makes the Cold Chain?

One aspect of this segment of commercial real estate is that we can all relate to every part along the chain, shown below. Except for 1) overlapping purposes, 2) pharmaceuticals, 3) micro-production/artisanal, and 4) lab-made/indoor farming/vertical farming, the cold chain looks like this:

Each step has commonalities and differences, depending on the raw material (i.e., eggs vs. strawberries) and vastly disparate cooling requirements. Within the most efficient cold storage buildings, one might have a box-in-box configuration allowing a chocolate cold storage “box” or room, to keep it from melting in the same large space as a warmer banana-ripening box.

Which raw materials go to which manufacturing or processing plants? Do the eggs get dried, separated, or deviled? Are they folded into a cake mix? Does the meat from the cow get butchered into quarters, ground into sirloin burgers, or cooked for ready-to-eat meals? Does milk get packaged into quart containers, dried for baking, or used for making cheese? The variables are as endless as they are crucial to decision-making.

Once the raw material is processed, how is it stored? How is it packaged? Does it have to be merely cold, or must it be frozen? Does it go to a distribution center that is a 3PL (third-party logistics) facility or to the more specialized PRW (public refrigerated warehouse)? Each processing center has specialized requirements, some with parking requirements like a big-box warehouse to accommodate a labor-intensive food-processing plant that might require cold processing, thermal processing, or simple cleaning and sorting.

While cold storage is complicated (and risky) at first sight, it also offers pockets of high growth. PRWs accounted for 42% of the new-builds, 17% of the build-to-suits, and 41% of spec developments (caused by scarcity from trade partners.)

Cold Storage Keeps the Chain Unbroken

Bottom line: While cold storage is critical to the success of our food handling model, eager financiers must understand its usage and be aware of potential risks before investing here.

The end-user drives the train. A restaurant has different needs than a working parent, who would have different expectations from an organic or natural foods market, whose business model and food handling may be vastly different than a mainstream store. The eager cold storage investor must be aware of these nuances.

Investors have to evaluate cost, risk, and service across the chain. They will consider access and location related to 1) the raw goods end and 2) the distribution and end-user parts of the train, not to mention everything in between.

It’s not just food, and it’s not just the domestic cold storage conundrum. Micro forces, like those for pharmaceuticals, which represent a very small percentage of the whole, can force attention to detail that food may not require. Macro considerations like tariffs and emerging markets with different requirements should cause investors to take their time before jumping in.

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s I.CON West 2025. Learn more about JLL at www.us.jll.com or www.jll.ca.